Imagine spending countless hours creating a high-quality product or service, only to have your customers delay or avoid payment.

When running an online business, setting the ground rules with clear payment terms and conditions isn’t just good practice. It’s crucial for your peace of mind and your bottom line.

Without it, you are essentially risking your operations and putting your financial stability on the line. Below, we’ll talk more about why you need one, as well as how you can draft fair payment terms and conditions to safeguard your business’ future.

- Clear payment terms and conditions help you get paid on time and secure your business cash flow.

- Including penalties for late payments in your terms discourages delays.

- Regularly updating payment terms keeps them effective as your business grows.

Table of Contents

PRO TIP: Take the hassle of writing your own terms and conditions away with our terms and conditions generator trusted by over 200,000 businesses. It’ll save you hours of work and possible costly legal mistakes.

What Are Payment Terms in Terms and Conditions?

Payment terms are the conditions outlined in a contract that specify when a payment is due, the accepted payment methods, and any late payment penalties.

So, when you include payment terms in your T&C, you’re setting clear expectations about how and when you expect to be paid.

But what does this look like in practice for an online business? For an online store, the payment terms are where you can specify whether payment is required before shipment or within 30 days of receiving an invoice.

It can also tackle how you handle late payments, including charges or the conditions under which services will be suspended.

Why Do You Need a Payment Terms Clause?

You need a payment terms clause in your T&C because it provides a structured approach to managing your business’s financial transactions.

Basically, contract payment terms are important:

- To ensure you have a predictable cash flow, which will then allow you to plan and manage your business finances more effectively;

- To align the delivery of goods or services with payment schedules;

- To build a stronger business relationship with your customers by reducing conflicts and misunderstandings;

- To accommodate the varying needs of your customers, such as by offering flexible payment options; and

- To handle disputes and non-payment in the best way.

As an online business owner myself, I’ve seen firsthand how a clear payment terms contract can make all the difference.

From my experience, payment terms serve not just as a guideline but as a cornerstone of your financial strategy. Having clear terms in place will help you avoid many potential headaches.

This is because when you define your payment expectations, you and your customers know exactly what to expect. In turn, you eliminate any ambiguity that might lead to delays or disputes.

A well-crafted payment terms clause isn’t just about protecting your interests. It’s about creating a professional and transparent environment where your business can thrive.

How To Determine Payment Terms for Your Business

To determine the payment terms for your business, you have to consider what will work best for both your operations and your customers. You can do that by following these steps:

Step 1: Assess Your Cash Flow Needs

How quickly do you need funds to maintain operations? The answer to this will guide you in setting payment terms in your terms and conditions that ensure you receive payments in a timely manner.

Step 2: Understand Common Payment Terms

Familiarize yourself with common payment terms used in your industry. Whether it’s net 30, net 60, or due on receipt, knowing the norms can help you align with standard practices while meeting your financial needs.

Step 3: Analyze Customer Payment Behaviors

Look at historical data to see how your customers typically make the payment. This can help you tailor your terms to match customer preferences and payment histories.

In my experience, using accounting software like QuickBooks, Xero, or FreshBooks can be invaluable. These tools offer features that track and analyze payment histories, providing insights into typical payment timelines and methods your customers prefer.

Additionally, integrating a Customer Relationship Management (CRM) system can help you correlate payment patterns with specific customer interactions and sales data, giving you a comprehensive view of customer habits.

Step 4: Consider Market Standards

When it comes to payment terms, aligning with what is commonly accepted in your market can prevent potential friction with clients. At the same time, it can also help maintain competitiveness.

Step 5: Consider Offering Flexibility

Depending on your industry and client base, payment terms also might include flexible options like early payment discounts or staggered payments to accommodate different customer needs.

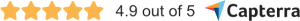

For instance, according to Statista Consumer Insights, roughly half of U.S. adults have used Buy Now, Pay Later (BNPL) services and about 40% of those who haven’t could imagine doing so in the future.

This trend reflects a broader desire for flexibility in payment methods, particularly options that avoid additional costs. Offering flexible payment terms can meet these consumer preferences, potentially increasing customer satisfaction and loyalty.

PRO TIP: Before finalizing your terms & conditions of payment, communicate them with your customers. Be open to negotiation if it helps establish a long-term, mutually beneficial relationship.

8 Key Components of a Clear Payment Terms Clause

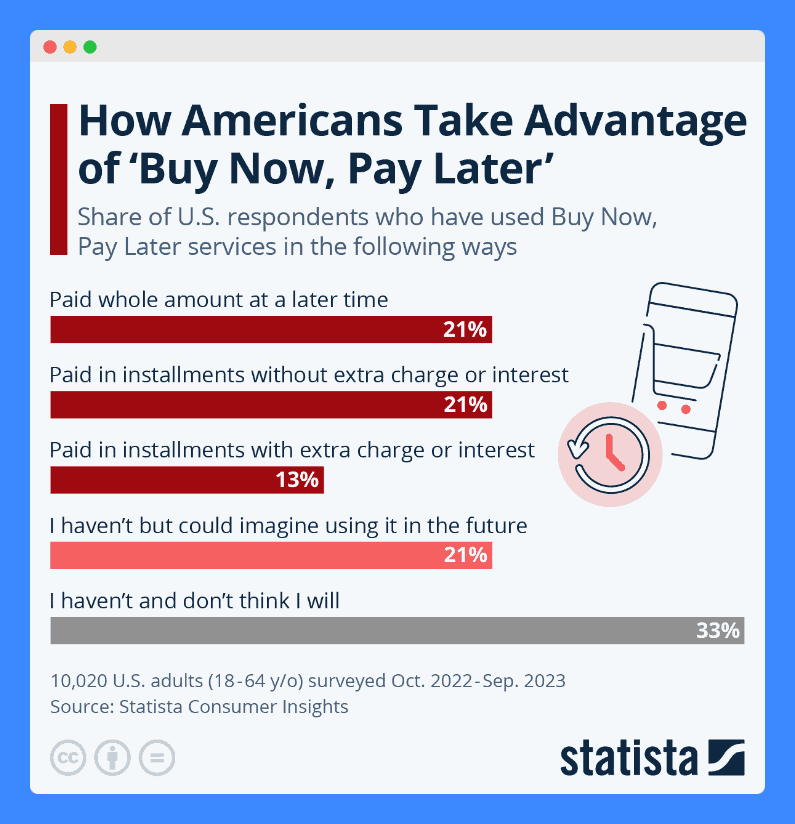

A well-crafted payment terms and conditions clause must be clear, fair, and enforceable so everyone involved understands their obligations from the start. Here are eight essential elements to include:

1. Payment Schedule

This section outlines the specific payment deadlines by which customers must make their payments, defining the payment due date and the frequency of these payments.

Here are the different types of payment terms you can implement:

- Immediate Payment Terms: This requires that payment is made immediately upon order placement or before delivery.

- Traditional Payment Terms: Often referred to as standard payment terms, these include scenarios where payment is made within a set number of days of the invoice date, such as Net 30, which means payment is due within 30 days after the invoice is issued.

- Extended Payment Terms: These allow for payments over a longer period. Extended payment terms may include interest or additional fees under specific conditions, such as for large-scale orders or repeat customers.

Communicate these details in your invoice payment terms to avoid any misunderstandings and to ensure payments are made timely.

2. Accepted Payment Methods

Here is where you outline the acceptable payment methods customers can use to pay for your products or services. Different types of payment methods are accepted to accommodate various customer preferences and provide convenience.

Common forms of payment include:

- Traditional payment methods like cash, checks, or money orders

- Online payment, including credit cards, debit cards, digital wallets (e.g., PayPal, Apple Pay, Google Pay), and bank transfers

- Different payment channels, such as mobile payments, cryptocurrency, or other emerging payment technologies

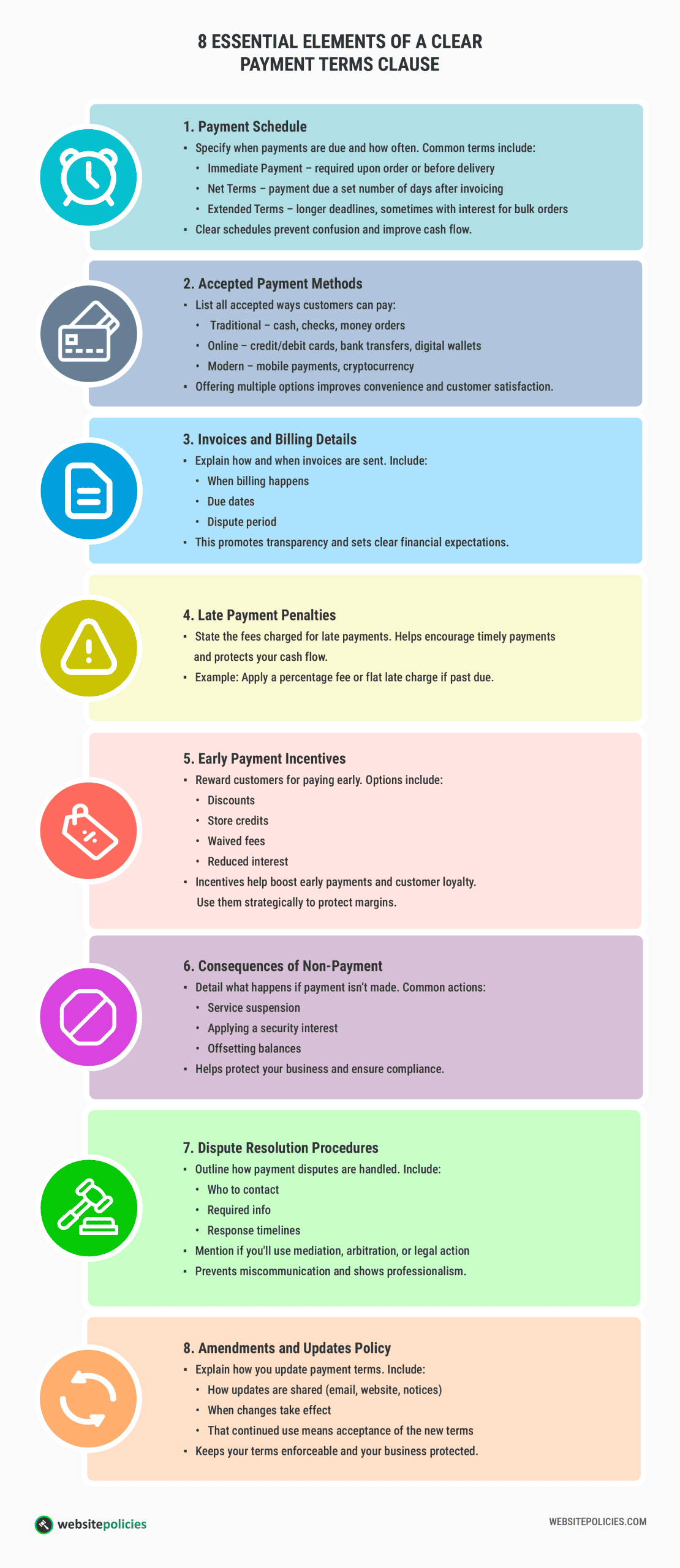

Reflecting recent trends, it’s important to note that debit card and credit card payments remain the most popular online payment methods among U.S. consumers.

This data shows how traditional card payments are still holding strong, even as we dive deeper into the digital age.

Nevertheless, it’s my professional opinion that it’s always good to keep things fresh and varied. Offering a mix of payment options not only meets different customer needs but also makes the whole shopping experience smoother and more enjoyable.

3. Invoices and Billing Details

In this section, you outline the procedures and specifics for issuing invoices and detailing billing information. Doing this shows transparency in how you handle every financial transaction.

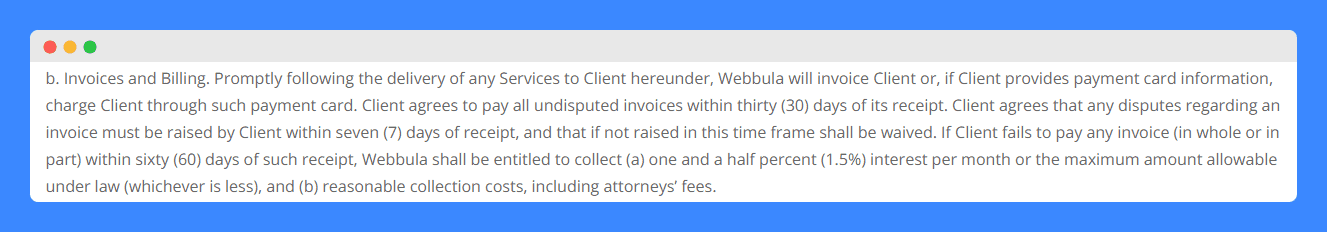

For example, in its Terms of Service page, Webbula states that an invoice is generated immediately following the delivery of services or, if the type of payment is on file, the client’s card is charged directly.

The experts at this data quality technology and consultancy company also saw how important it is to make payment terms clear, specifying that clients agree to pay all undisputed invoices within 30 days of receipt.

Furthermore, the terms include specific conditions like requiring disputes about invoices to be made within seven days, after which the right to dispute gets waived.

This structured approach ensures that both parties understand their financial obligations and the consequences of non-compliance.

4. Late Payment Penalties

As an online business owner, you know how crucial timely payments are for maintaining your cash flow and operational stability. This section is, therefore, an essential clause in your payment terms, serving as a deterrent against late payments.

List the charges or fees that will apply when payment is not made by the due date. These penalties can help encourage timely payments and compensate the business for the inconvenience and potential cash flow issues caused by the delay.

PRO TIP: Set an automatic reminder to notify clients a week before payment is due. It reduces late payments without needing to enforce penalties.

5. Early Payment Incentives

While late payment penalties can deter customers from delaying payments, offering early payment incentives can encourage them to pay promptly. This can benefit your business by improving cash flow and reducing the need for collection efforts.

Early payment incentives are rewards or discounts offered to customers who make payments before the due date. You can:

- Offer a discount on the total amount due if payment is made in advance;

- Provide a credit that can be used for future purchases;

- Waive a portion of the payment if settled early; or

- Reduce interest rates for those who availed of financing options.Offer a discount on the total amount due if payment is made in advance;

- Provide a credit that can be used for future purchases;

- Waive a portion of the payment if settled early; or

- Reduce interest rates for those who availed of financing options.

Remember to balance the benefits of advance payment incentives with the potential impact on your cash flow. If offering significant discounts or incentives could negatively affect your profitability, consider limiting them to certain customers or situations.

6. Consequences of Non-Payment

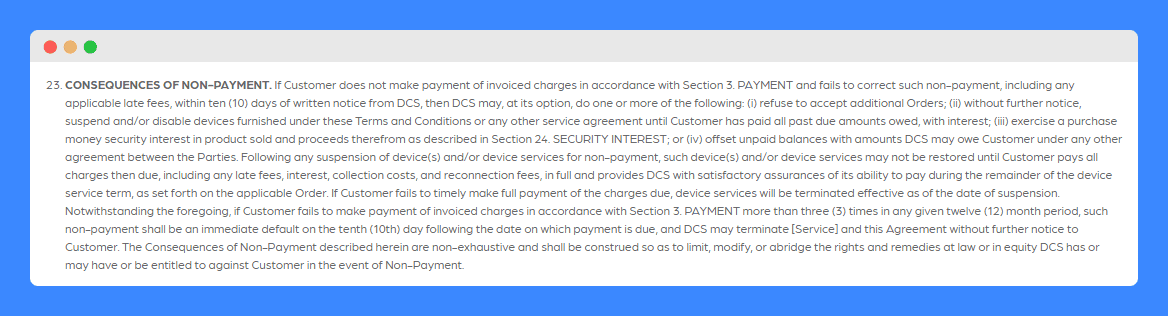

This section is where you outline the actions your business will take if invoices remain unpaid beyond the agreed payment terms. Let’s look at DCS Solutions’ non-payment clause:

In this payment terms and conditions example, DCS Solutions makes it clear that they can suspend services, exercise a security interest, and offset unpaid balances if customers fail to pay their dues on time.

PRO TIP: Ask for a lump sum payment upfront if you deal with large or complex projects. This will lower the risk of non-payment and ensure you have the necessary resources to complete the job.

7. Dispute Resolution Procedures

Any good business owner knows how important it is to have a method in place to discuss payment disputes efficiently.

To do this, outline the steps your customers should follow if they disagree with a charge. This could include who to contact, the information needed, and the timeframe for resolving the issue.

Additionally, you can specify whether:

- Mediation will be the initial step, where a neutral third party helps the parties reach a mutually agreeable solution;

- If mediation fails, arbitration will be used, where a neutral third party makes a binding decision; and/or

- As a last resort, legal action will be taken if the dispute cannot be resolved through mediation or arbitration.

8. Amendments and Updates Policy

This refers to the process for making changes or updates to the payment terms clause in the contract. For transparency, include in your terms the following:

- Notification of changes: Specify how you will notify customers of any changes to the payment terms. This could include email, website updates, or physical notices.

- Effective date: Indicate when any changes to the payment terms will take effect.

- Customer acceptance: State that customers will be deemed to have accepted any changes to the payment terms if they continue to use your products or services after the effective date.

By adding these key elements, you can ensure that your terms remain up-to-date and enforceable. This can help protect your business interests and avoid any misunderstandings with customers.

How to Write a Payment Terms Clause in Your Terms and Conditions?

Here’s a step-by-step guide on how to write payment terms and conditions from scratch:

Step 1: Review Your Business Needs

Understanding payment terms and conditions starts by learning about your own business needs. Evaluate your current business operations and financial requirements.

Step 2: Check out Free Templates

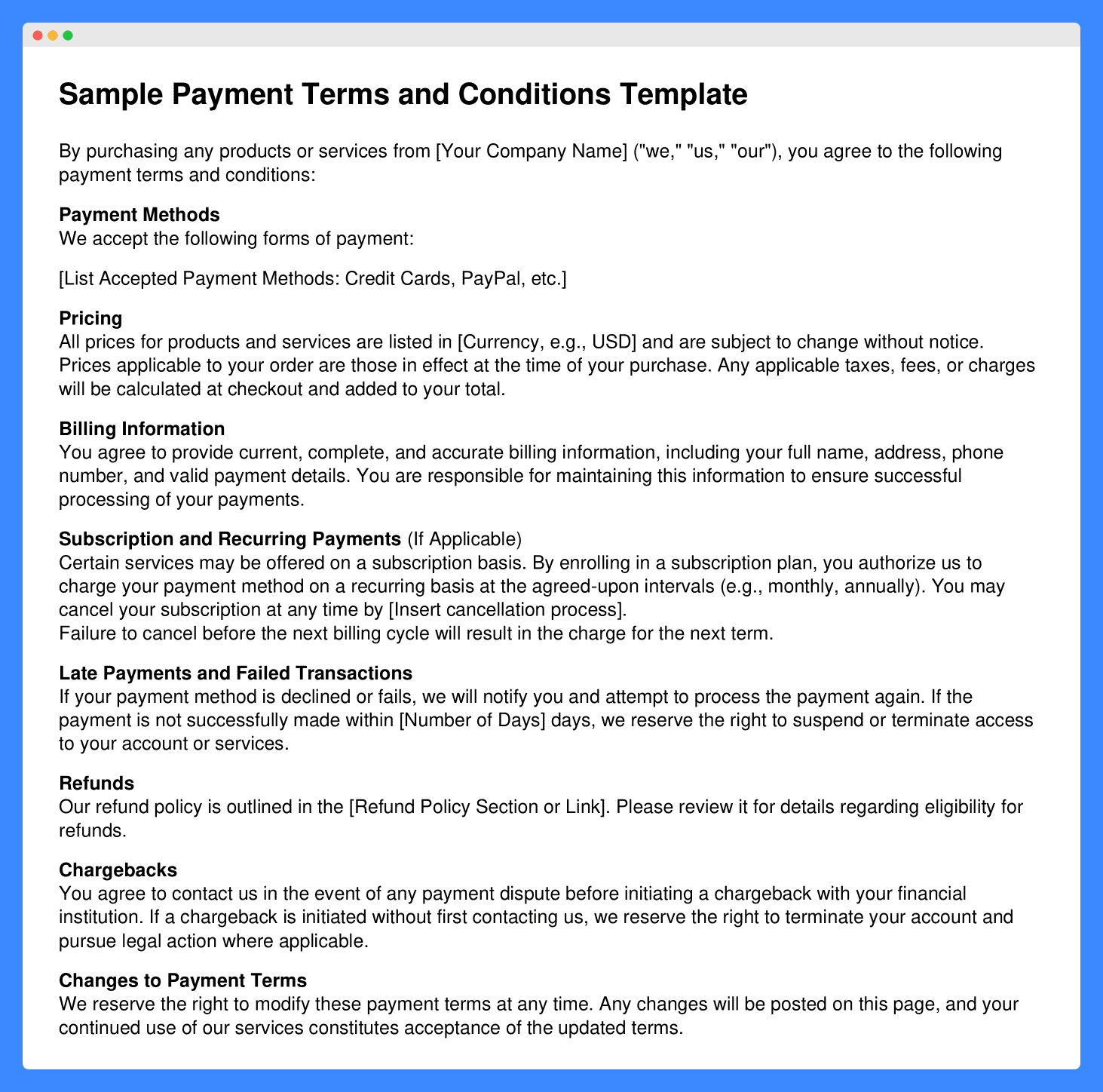

Look at pre-designed templates to understand how to structure payment terms and conditions. Our free template, for example, offers a user-friendly layout that includes all the essential elements of effective payment terms.

You simply select the sections that align with your business needs and fill in specific details like payment schedules and methods. This approach not only saves time but also ensures you cover all legal bases.

Step 3: Integrate All Necessary Components

Make sure it covers all essential aspects without redundancy. Doing this extra step helps guarantee that your terms are clear and enforceable.

Step 4: Implement and Communicate Changes

Once your payment terms are set, implement them clearly across your business platforms. Communicate any changes to these terms to existing customers through your chosen channels.

While crafting effective payment terms from scratch is possible, you can simplify the process using our terms and conditions generator. This tool is designed to adapt to the nuances of your specific business needs.

It will walk you through a series of questions about your business operations, payment methods, and preferences. Based on your responses, it will generate a tailored set of terms that are legally compliant and specific to your business model.

Best Practices When Writing a Payment Terms Clause

Adding a comprehensive payment terms clause to your T&C agreement is crucial for safeguarding your business operations. Here are some strategies to ensure your clause is both effective and enforceable:

- Check that your payment terms policy complies with local and international laws, especially if you deal with customers from different jurisdictions. This compliance helps prevent legal conflicts and enhances the enforceability of your terms.

- Be meticulous in defining the set of payment terms. Specify exact due dates, acceptable payment methods, and any interest on late payments to avoid ambiguity that could be exploited.

- Include provisions that address scaling, such as different terms for larger orders or long-term contracts. This is so that as your business grows, your terms and conditions agreement can help manage changes in volume and transaction size.

- While using legal terms is necessary, ensure your terms and how to use them are understandable to non-legal professionals. Clear language helps prevent misunderstandings and makes the agreement accessible to all parties involved.

- Provide examples when appropriate. Sometimes, illustrating how a term would work in a real scenario can clarify expectations. This is particularly useful when explaining the calculation of late fees or discounts for early payments.

- Mention in your payment terms clause in the contract how amendments will be handled and communicated. This way, both parties are aware of how updates to the terms will be made.

Payment Terms and Conditions Clause Template

This payment terms and conditions template provides a solid foundation for crafting your own terms and conditions. It outlines the key elements that every business should consider, including payment methods, pricing, billing information, and policies for refunds, chargebacks, and subscriptions.

Consider adding any details unique to your business, such as subscription plans or late payment fees. This way, you’ll create a personalized and legally sound document that protects both your business and your customers.

Examples of Payment Terms and Conditions

Below, you’ll find examples of payment terms and conditions that can serve as models for structuring your own agreements. These examples highlight various approaches tailored to different business needs:

1. Airbnb

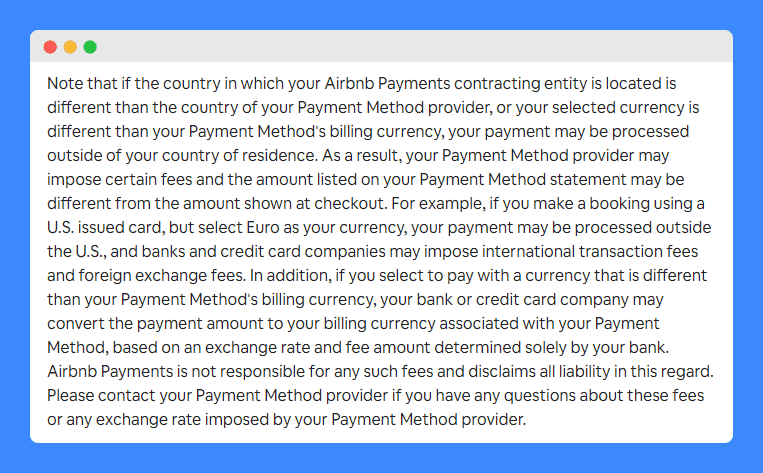

Airbnb provides a prime example of a company that effectively employs clear and understandable payment terms and conditions.

For instance, as a global platform that connects hosts and travelers from various countries, Airbnb has to maintain transparency in its payment processes, especially considering the diverse banking regulations and practices across different regions.

In their payment terms, Airbnb uses clear language to outline the responsibilities of both hosts and guests.

They also make it easier for users to understand the payment conditions by providing examples, such as detailing how there may be extra charges if you pay using a currency different from the bank you used for booking.

2. Sprout Social

Sprout Social is another excellent example of a company with an effective payment terms clause in its Terms of Service.

More than anything, it balances the necessity of maintaining operational liquidity with the need to treat customers fairly. This makes their payment terms a model of clarity and equity.

This clause clearly outlines the terms related to payment by invoice. In turn, this transparency helps customers understand their obligations and the importance of timely payments.

It also shows reasonableness in terms of subscription renewal and fee adjustments. It not only allows for automatic renewal but also caps any potential increase in subscription fees, so customers are not caught off guard by significant price hikes.

3. AJE

AJE (American Journal Experts) provides another excellent example of how payment terms can be crafted to offer flexibility to customers.

Their payment terms and conditions in the contract demonstrate a commitment to accommodating various payment preferences and providing clear guidelines.

These terms demonstrate flexibility by offering multiple payment options, allowing for subscription cancellation within 14 days, and providing a credit for overpayments. This demonstrates a commitment to customer satisfaction and adaptability.

4. BambooHR

BambooHR provides a clear example of how payment terms and conditions sample for business can incorporate discounts to incentivize customers.

This part of their terms of service outlines specific conditions for obtaining and maintaining discounts. In turn, this demonstrates BambooHR’s focus on being transparent and fair.

Doing this not only enhances customer loyalty but also stabilizes the company’s revenue stream by encouraging longer subscription periods and service bundling.

5. Google Cloud

Google Cloud’s payment terms within its Terms of Services show how you can strategically align your terms with broader business objectives. These terms incentivize timely payments by applying interest to late payments.

Moreover, Google Cloud specifies that this interest penalty does not apply to amounts under a good faith payment dispute if raised before the due date. This demonstrates their commitment to fairness and customer communication.

Frequently Asked Questions

How do payment terms and conditions protect businesses?

Payment terms and conditions protect businesses by ensuring timely cash flow and reducing financial risks. Establishing the right payment terms helps maintain operational stability.

How can businesses enforce payment terms and conditions?

Businesses enforce payment terms by setting clear penalties for late payments and suspending services if necessary. Legal action can also secure compliance.

Can I update the payment terms clause after the agreement is signed?

Yes, you can update the payment terms clause with mutual consent. Ensure changes are documented and agreed upon in writing.

How can I address disputes over payment terms in the agreement?

Include a dispute resolution process in the terms or even mediation clauses. It’s also important to establish clear communication channels.

What payment methods should be specified in the payment terms clause?

Specify all accepted payment methods like credit cards, bank transfers, and digital payments. This clarity helps avoid confusion and delays.